Hi All, this is our first (official) fundamental stock pick as we seek to create a place with both fundamental and technical ideas for sharing with investors and traders reading our blog. Welcome any feedback and ideas from our readers.

We will also be including it in our model dummy fundamental portfolio to track the performance of our investment track record (mostly for our own learning purposes). For fun reading and sharing. Happy holidays! :)

Hong Kong Land

About

One of the largest property developer and investment group in Asia, owning and managing almost 800,000 sqm of prime office and retail property in key Asian cities. Hong Kong and Singapore made up bulk of the portfolio with 452,000 sqm (56%) and 165,000 sqm (20%) respectively.

List of properties: http://www.hkland.com/en/properties/list.html

FY16 Operating income by segment:

Commercial property: 77.8% (should be mostly investment property rental income)

Residential property: 22.2% (should be mostly property dev profits)

|

|

|

|

|

Source: HKL

|

|

My View:

- While this is just an over simplistic way of looking at the stock, I see HKL as a good proxy to the property market in HK, with its Grade A office assets in Central HK, that may benefit from the booming Chinese economy. Valuations are also backed by its grade A prime office and retail properties such as (Exchange Square, Forum, Jardine House etc in HK, and 33% owned One raffles Quay and MBFC in Singapore).

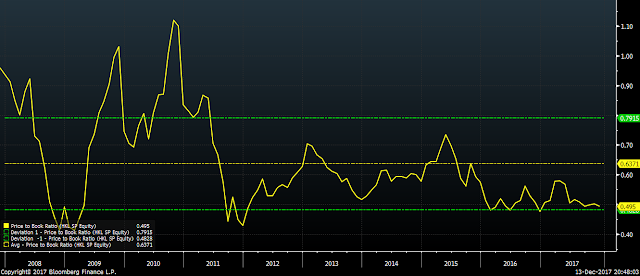

- With P/B near a multi year low (0.5x), and potential for rise in dividend in the near term (given the dividend history and potential increase in rental income from contributions from new assets, and also multi year low net gearing), think HKL may be a good addition to my medium to long term portfolio at $7.22.

- While waiting, I get a dividend yield of 2.6 % (based on current DPS of $0.19- same as CPF – might as well)

Investment merits:

Trading At 0.5x P/B (with most of its assets at prime locations in cities such as Hong Kong and Singapore), which is near a multi year low and -1SD of its 10 year range. Also attractive when vs its peers like CK asset, Swire properties and Champion REIT who are trading at 0.6-0.9x P/B.

P/B is near a multi-year low and -1SD of its 10 year range.

Source: Bloomberg

Leasing momentum slowed, but overall rental growth still positive in HK. The vacancy rate for prime office space in HK Central rose to 2.4% in 3Q from 1.7% in 2Q, according to Colliers International. According to Colliers, Rents in Central/ Admiralty increased 0.4% QOQ, supported by sustainable renewal and new demand irrespective of the rising relocation trend. Hong Kong’s office area forms 48% of HKL’s total investment portfolio (by floor area).

- · For 1H18, HKL’s HK central office portfolio as at 30th Jun 17 maintained its high occupancy rate with only 1.5% vacancy rates. Average office rent rose to HK$106 psf vs HK$103 in 1H and 2H 16. Its HK central retail portfolio was 99.4% occupied with little change in base rents. There were some mildly negative rental reversions in its Sg office portfolio (S$9.1 psf vs $9.4 psf and $9.2 psf in 1H and 2H16 respectively), but occupancy rate remained strong with vacancy of only 0.2% as at end of Jun 17.

New contribution from Beijing retail mall coming on stream in 4Q? (84% owned) WF Central (Beijing ) comprising luxury retail complex and 74 room Mandarin Oriental hotel is scheduled for completion in late 2017 and 2018 respectively.

Good free cashflow yield… As a result of its steady rental income from investment properties, HKL typically generates very good free cash flow of more than US$500m in the last 3 years (FY16: US$948m, translating to a free cashflow yield of 5.5%). This has helped it continuously pare down its net gearing to only 5.5%, which will allow HKL to scoop up good assets if investment opportunities arises.

US$m

|

FY 2012

|

FY 2013

|

FY 2014

|

FY 2015

|

FY 2016

|

Last 12M

|

12 Months Ending

|

12/31/2012

|

12/31/2013

|

12/31/2014

|

12/31/2015

|

12/31/2016

|

06/30/2017

|

Cash From Operations

|

299

|

908

|

699

|

896

|

1,096

|

1,202

|

Capital Expenditures

|

(515)

|

(134)

|

(137)

|

(152)

|

(148)

|

(139)

|

Free Cash Flow

|

(216)

|

774

|

562

|

744

|

948

|

1,063

|

Net Debt To Shareholders Equity

|

12.5%

|

11.2%

|

9.6%

|

8.1%

|

6.4%

|

5.5%

|

Source: Bloomberg

and potential for rising dividends? Noted that dividend/share has been stagnant for 2014-2016 at US$0.19 (dividend yield: 2.6%). If you study the pattern of its dividend payment, DPS remained at US$0.16 from 2009-2011 (3 years) before slowly increasing DPS by US$0.01/year from 2012-2014. If 3 years is a cycle, can we potentially see management raising dividend again this year by at least US$0.01 (or best 1 shot US$0.03). This is considering the potential rise in core investment property rental income (from the potential positive rental reversion in its HK office rentals, new revenue contribution from the new mall in Beijing, WF Central (84% owned) which will be coming up soon in 4Q, and continuously decreasing net D/E which is now at 5.5% (lowest in years)

US$

|

FY 2008

|

FY 2009

|

FY 2010

|

FY 2011

|

FY 2012

|

FY 2013

|

FY 2014

|

FY 2015

|

FY 2016

|

Dividends per Share

|

0.13

|

0.16

|

0.16

|

0.16

|

0.17

|

0.18

|

0.19

|

0.19

|

0.19

|

Diluted EPS

|

(0.05)

|

0.78

|

2.02

|

2.27

|

0.61

|

0.51

|

0.56

|

0.86

|

1.42

|

Dividend Payout Ratio

|

—

|

19.8%

|

7.6%

|

7.0%

|

27.8%

|

35.6%

|

33.7%

|

22.2%

|

13.4%

|

Source: Bloomberg

Technically, prices have been consolidating between $7.10-7.80, after a strong rally from $5.95 at the start of the year. With prices near the low end of the trading range, and potential near-term catalysts such as the completion of the 84% owned WF Central in Beijing and hopefully higher dividends (my guess- prays), hopefully the stock will be ready to retest $7.80 and breakout soon.