Our view:

Currently no TP on it, as liked HLS due to its good dividend yield, and as we hope to ride it as a proxy to the pick up in local construction demand. We believe current valuations are backed by the earnings visibility it has for the next 4 years, dividend yield of 3.6-5%, and strong cash/investments of S$0.29/share. Upside will come from the sale of industrial property dev, and winning new contracts.

Currently no TP on it, as liked HLS due to its good dividend yield, and as we hope to ride it as a proxy to the pick up in local construction demand. We believe current valuations are backed by the earnings visibility it has for the next 4 years, dividend yield of 3.6-5%, and strong cash/investments of S$0.29/share. Upside will come from the sale of industrial property dev, and winning new contracts.

Hock Lian Seng (HLS) is a BCA grade 1 contractor, with over 40 years of experience in the civil engineering and infrastructure projects in Singapore- with projects including MRT depots, bridges, expressways, water infrastructures and other specialised marine works.

Investment merits

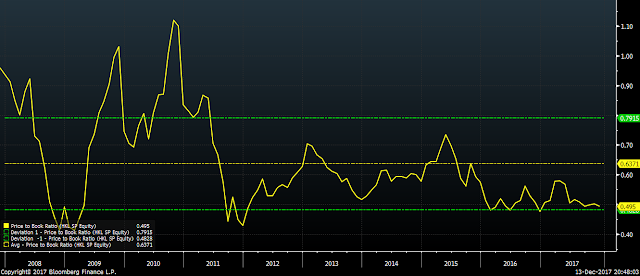

A reputable civil engineering co. with over 40 years of experience and an established track record trading at 11.2x forward PE and ex(cash and investment securities) PE of 4.7x.

Strong balance sheet with net cash and investment securities of S$0.29/share (2016 mix: 84% corporate bonds, remaining in AFS equities)

A near 100% cash company by end of 4 years? We estimate that the current order book if executed smoothly, may help HLS earn NPAT of S$22m/year for the next 4 years, and become a near 100% cash company by the end of the period, as it is trading at 4.7x forward ex(cash and investment securities) PE. (We assume HLS can sell out its industrial property shine@tuas which it is currently holding on its b/s at about S$96m- (believe will still incur more dev cost of about S$10-15m by the time it TOP), which will sort of net out the other liabilities in the balance sheet)

- industrial development Shine@Tuas South doesn’t seem to be selling that well (maybe due to the sector) - is slated for completion by 2Q18. We personally don’t think HLS will make a loss on it (noted that they are also constructing it themselves), but probably won't make a lot too depending on how fast they want to sell it. The location is not too bad, as it is near the tuas mega port which will start opening in phases from 2021

Positive industry outlook. (BCA projects the total construction demand to be awarded for 2018 to be between $26b-31b, up from $24.5b 2017E, driven by both private and public-sector projects. Major civil engineering contracts to be awarded include North-South corridor, new MRT works and deep tunnel sewage phase 2 etc)- Link to BCA press release

A dividend yield of 3.6-5%. HLS has proven to be a good pay master in the past, steadily increasing its dividend payment over the years, with at least S$0.01625 DPS since 2010. In 2016, Management declared a total DPS of S$0.125 (S$0.10 special dividend, S$0.025 normal dividend). Assuming it maintains its normal dividend of S$$0.018-0.025, translates to yield of 3.6-5% (which is well supported by its strong balance sheet and good cash flow generation)

Risks

Costs overrun, margins not as high as expected, inability to win contracts etc

Also noted that while historically the capex for HLS is quite low at S$1-3m/year, in 2016-2017, there is a huge rise in CAPEX as it purchase more PPE and build warehouse (mentioned for its ongoing projects)- not sure how much more it will still incur, which may reduce its cash pile abit, but if we view it positively, hopefully they are expanding their fleet too so they can bid for their other projects given the pick up in local construction demand and not just be tied down to the Changi airport projects.

___________________________________________________________________

What we think HLS's earnings will be in the next 4 years?

Changi airport JV project with SCI only started contributing significantly in 3Q17. In its 3Q17 comments, HLS mentioned that the main rise in revenue (qoq and yoy) was due to the revenue contribution from the Changi airport JV project with SCI (where its 60% owned JV won a $1.1b contract from Changi airport which will run through 2022). In its 2Q17 commentary, contribution from this Changi airport JV is not yet significant, so 3Q17 was the first real quarter where revenue contribution from the project really kicked in (even though it was awarded only in Aug 16)

YE 31 Dec

|

1Q16

|

2Q16

|

3Q16

|

4Q16

|

1Q17

|

2Q17

|

3Q17

|

Revenue

|

23.6

|

31.6

|

29.6

|

33.3

|

28.0

|

23.2

|

49.5

|

cost of sales

|

(22.2)

|

(30.1)

|

(23.0)

|

(12.6)

|

(25.6)

|

(22.0)

|

(42.0)

|

GP

|

1.4

|

1.6

|

6.6

|

20.6

|

2.4

|

1.2

|

7.4

|

Adjusted GP margin

|

6.1%

|

5.0%

|

22.3%**

|

17.0%**

|

8.6%

|

5.2%

|

15.0%

|

**Adjusted GPM for 3Q16 were higher due to finalization of accounts for a few completed construction projects at end of defect liability period, such as Ark@Gambas, Ark@KB. 4Q16 GP was also helped by a $15m writeback of maintenance cost provision for completed projects (which we have already excluded in our adjusted GP calculation)

If we have a look at the quarterly results, prior to 3Q17, sales were about S$23-30m, which we believe should be from projects such as Maxwell station, stabling yard at Gali batu etc. Noted that this is a huge step up in sales and gross profit from 1Q and 2Q17. In its 3Q17 commentary, HLS attributed the rise in revenue mainly due to the contribution from the Changi Airport JV project. Hence, our 2 cents view is, it is reasonable to believe that the Changi Airport JV project has a much higher GPM than the other existing projects that HLS is currently working on.

Back of the envelope calculation

Assuming 1Q17 and 2Q17 revenue were derived mainly from projects such as Maxwell station etc (minimal contribution from Changi airport JV project), and these projects continue to contribute to HLS in 3Q17, we estimate the revenue and gross profit contribution from the new Changi JV project in 3Q17 to be about S$24m sales and S$5.6m in gross profit, implying a GPM for the project of about 23.6%.

sales

|

GP

|

GP margin

|

|

Assumed average of 1Q17 and 2Q17 sales and gross profit (from other projects)

|

25.6

|

1.8

|

7.0%

|

Assumed revenue contribution from new changi JV

|

23.9

|

5.6

|

23.6%

|

3Q17 results

|

49.5

|

7.4

|

15.0%

|

Based on the current order book of S$830m, we assume the mix of the order book is currently

Order book

|

S$830m

|

Blended GP margin mix: 19.8%

|

||

Changi JV

|

S$640m

|

23.6%

|

We less off the assume revenue contribution from the project in 3Q17

|

|

Others (eg. Maxwell station)

|

S$190m

|

7.0%

|

Based on the back of the envelope calculation, we assume the following

- S$50m of sales per quarter (this will last them about 16 quarters or 4 years based on current order book of S$830m)

- Assume GPM margin of about 18% (vs assumed order book mix blended GP margin mix of 19.8%)

- Other costs (distribution, admin, other operating costs etc) per quarter of about S$2m. (From 1Q16 to 3Q17, other costs excluding change in fair value has been about S$1m-1.8m)

- Other income of S$0.75m/quarter (HLS recorded interest income from loans, investment securities of S$3.5-4.5m/year for 2015-2016)

Based on quarterly sales of S$50m, we estimate, HLS can recognised net profit of S$5.7m/quarter or S$23m/year. And the order book of S$830m, can last/provide earnings visibility HLS for another 4.2 years (assuming S$50m sales recognised per quarter)

| Remarks | ||||

| Orderbook | 830 | |||

| no. of quarters it can be recognised | 16.8 | |||

| no. of years | 4.2 | |||

| S$m | ||||

| Sales/quarter | 49.5 | |||

| GP/quarter | 8.9 | Assume GPM of 18% | ||

| Other costs/quarter | -2 | |||

| 6.9 | ||||

| Increase in depreciation | -0.8 | PPE increased by S$16m in 9M17 due to acq of office units for own use, construction of warehouse, purchase of PPE to meet requirement of ongoing projects- We depreciate it over 5 years | ||

| Other income | 0.75 | interest income about $3-4m/year in 2015-2016 | ||

| PBT per quarter | 6.85 | |||

| Tax (17%) | -1.17 | |||

| NPAT per quarter | 5.69 | 11.5% NPM | ||

| Annual NPAT | 22.8 | |||

GPM : Gross Profit Margin

PBT : Profits Before Tax

NPAT : Net Profit After Tax

NPAT : Net Profit After Tax