Sunningdale- a value stock for the patient investor

Sunningdale has fallen as much as 48% from its high

following a sector de-rating and a dismal 1Q18 results. There are other reports

and blogs out there citing the main reasons of why it’s a value pick. Will not go

too much into it here, you can read it else where, I will just summarized the

main points below, and explain the rest of our thoughts.

- Attractive valuation: 3-3.3x FY18-FY19 EV/EBITDA, 6.6-8x FY18-FY19F PE, with a dividend yield of 5.5%

- Attractive dividend yield (rising dividend, sustainable payout ratio) – General rising trend over the years, FY17 dividend of S$0.07 translates to dividend yield of 5.5%, payout ratio of 43%

- Supported by good balance sheet and good cashflow generation (net D/E of 0.3%)

- Reputable management with skin in the game: Mr Koh Boon Hwee, the chairman of Sunningdale, is the largest shareholder of the company with a 15.8% stake according to Bloomberg. Of noteworthy, Mr Koh’s last purchase was in Apr 17, a 12.998m shares purchase at about S$1.717/share. (This is 43% of his current position)

- Potential takeover target

The recent entry of another value investor, LSV asset

management, is hopefully another affirmation of the potential value that is

current present in Sunningdale.

Where do we think the floor is

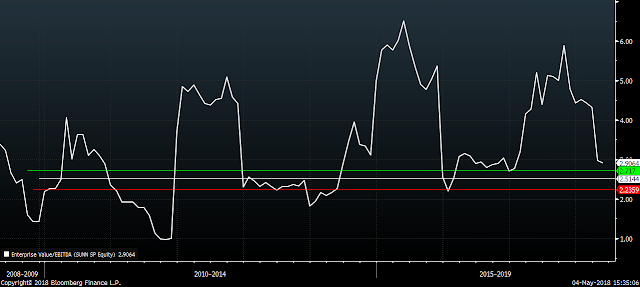

(potentially and hopefully) at? Notwithstanding a financial crisis, Sunningdale has traded at a floor

valuation of near 2.2-2.7x EV/EBITDA. We

use EV/EBITDA (to take into account the gearing of the group and because

depreciation is typically a huge expense to companies like Sunningdale)- this implies a potential price floor of

about 0.93-1.15 (if we work back based on consensus FY19 EBITDA)- that’s about

10-26% away or 10-30c away or S$20-60m market cap away. (We will look more at the 10-30c rather than the share price of 0.93-1.15, as we think there are potential for the "price floor" to be nearer.. see below)

our “floor” calculation is based on

EV/EBITDA, where EV (Enterprise value = Market cap + net debt + minority interest etc).

So assuming the consensus EBITDA is correct and constant, to reach our potential "floor EV/EBITDA" our EV has to come down by S$20-60m, which could come in either of the following ways:

- Share price has to drop more (i.e. drop in market cap) or

- Sunningdale has to have more cash (i.e. lower net debt), which could be potentially from

a. Proceeds from its potential disposal of its China factory. On 25 Apr 18, Sunnningdale announced its intention to dispose of

its factory in Zhongshan, as it is a non-core and excess asset. Depending on

how big it is, the potential sales proceeds may help to further improve the

balance sheet of Sunningdale and further lower its EV/EBITDA valuation towards our "floor"

b. Cash accumulated and generated from operations (which will take time) average Free Cash Flow generated/year since FY14 was S$20m. Operating

cashflow/EBITDA has averaged about 80% since FY09.

|

S$m

|

FY 2013

|

FY 2014

|

FY 2015

|

FY 2016

|

FY 2017

|

|

YE 31 Dec

|

|

|

|

|

|

|

Net Income

|

13.649

|

27.676

|

42.104

|

39.071

|

31.360

|

|

EBITDA

|

48.635

|

38.018

|

67.812

|

71.479

|

82.125

|

|

OCF/ Net income

|

319%

|

102%

|

162%

|

138%

|

123%

|

|

OCF/ EBITDA

|

90%

|

74%

|

101%

|

75%

|

47%

|

|

Cash From Operations

|

43.551

|

28.254

|

68.162

|

53.899

|

38.431

|

|

Capital Expenditures

|

-15.764

|

-13.658

|

-24.064

|

-36.031

|

-33.871

|

|

Free Cash Flow

|

27.787

|

14.596

|

44.098

|

17.868

|

4.560

|

|

Free Cash Flow Yield

|

11.2%

|

5.9%

|

17.8%

|

7.2%

|

1.8%

|

|

Net Debt

|

-19.463

|

33.915

|

-1.113

|

-13.828

|

-1.601

|

|

Dividends Paid

|

-4.549

|

-5.356

|

-7.418

|

-9.335

|

-15.985

|

|

DPS

|

0.035

|

0.04

|

0.05

|

0.06

|

0.07

|

|

Dividend Payout Ratio %

|

39.234

|

26.807

|

22.171

|

28.878

|

27.149

|

Our View:

Sunningdale ticks most of a value investor checklist of having a low P/B (0.6x), low PE (6-8x PE), good balance sheet (nearly 0 debt), good cashflow generation, good dividend yield and a reputable and good management with stakes in the company.

Investing is about following your investment checklist and buying good companies when its out of favour (sentiments etc)

When we look at Sunningdale now, the sector and the company is out of favour but do we think the sector will be in play again 1 day? (yes)

Do we think the company can get out of its current rut?

we dont know, but we think it can. The 1Q18 results is bad on first glance (-75% yoy) but its not end of the world. It is partly due to forex loss (excluding which, results is still -25%yoy to S$7m, due to lower consumer/IT sales from lower demand etc which had a double whammy effect as margins took a hit with the lower utilisation) Manufacturing is a cyclical sector- i think the more important question is if Sunningdale are reacting quick and enough to customers and are they maintaining and gaining new projects? From the results commentary, i think they still are.. as they cited a stable order book, and continued business enquires from new and existing customers and potential new projects which will be commencing mass production. They are still continuing investing in new technology and machinery to be cost competitive, and building new manufacturing sites to be near customers (sounds reasonable and sensible to me)

In our short investing journey in the local market, (we think) there are less and less manufacturing companies listed in Singapore as we see them gets privatised and/or taken over. This could be either due to low valuations of Singapore manufacturing co. (relative to likes of HK etc) and/or consolidation of the industry as customers nowadays look to consolidate their

suppliers (deal with a few rather many). M&A activity is likely to

continue as the industry consolidates and existing players look to grow their

economies of scale.

Prices

have found abit of a base here after falling more than 48%, and the emergence

of some value back to the stock. If we assume a "floor" valuation based on EV/EBITDA, hopefully a floor is in sights, and may be even nearer should the disposal of Sunningdale's China factory happen and be of a significant size. Even if it doesnt, Sunningdale has proven in the past to be highly cashflow generative which could help accumulate cash in its balance sheet and move it closer to its "floor valuation as time passes"

Will buy some here, but leave some

spare bullets. Remember this is still a very cyclical sector that is very

dependent on the economy strength (there have been increasing concerns of a recession lurking around

despite the current strength in the global economy), and not to mention how

fragile the market has been recently. Investors

have to take a medium- long term view on this, as we wait for earnings to

hopefully recover (led by a respectable management) and the sector to be in

play again